Table of Contents

Introduction | Taaruf

Aaj kal har shakhs apni mehnat ki kamai ko mehfooz aur munafa bakhsh jagah par invest karne ka sochta hai. Bank ek aisi jagah hai jahan log apna paisa rakhte hain taake wo mehfooz rahe aur zaroorat par istimaal ho sake. Lekin sawal yeh uthta hai ke bank mein paisa rakhna behtareen faisla hai ya phir koi aur option behtar ho sakta hai? Is article mein hum is baat ka tafseelat se jaiza leinge.

Bank Mein Paisa Rakhne Ke Faide | Bank Account Ka Faida

1. Mehfooz Investment

Bank mein paisa rakhne ka sabse bara faida yeh hai ke yeh aik mehfooz jagah hai. Ghar mein cash rakhna aksar risky hota hai kyunki chori ya kisi aur musibat ka khatra hota hai. Bank account is maslay ka behtareen hal hai jahan aapka paisa secure hota hai.

2. Asaan Transactions

Agar aapko kisi ko paisa bhejna ho ya kisi se paisa lena ho, to bank transfer ya ATM se transactions bohot asaan hoti hain. Aaj kal mobile banking ki wajah se ghar baithe transactions ki ja sakti hain jo waqt aur energy dono bachati hain.

3. Munafa Aur Saving Accounts

Agar aap saving account open karte hain to aapko har mahine ya saal ka ek fixed munafa milta hai. Yeh munafa inflation ke mukablay mein kam hota hai, magar phir bhi aapke paisay sirf rakhnay ke bajaaye barhtay hain.

4. Emergency Ke Liye Behtareen

Agar kabhi emergency mein paisa chahiye ho, to bank account se foran paisa nikalwana asaan hota hai. Ghar mein cash na hone par bhi bank ATM ya online transfer se foran zaroorat poori ki ja sakti hai.

Bank Mein Paisa Rakhne Ke Nuksan | Bank Account Ka Nuksan

1. Inflation Aur Purchasing Power

Agar aapka paisa sirf bank mein pada hai aur us par bohot kam munafa mil raha hai, to inflation ki wajah se iski value gir sakti hai. Iska matlab hai ke aaj jo cheez aap ek lakh rupay mein khareed sakte hain, wo kuch saalon baad isse mehngi ho sakti hai, jabke aapka paisa utna hi rehega.

2. Limited Munafa

Agar aap apna paisa kisi business ya investment mein lagate hain to iska munafa bank saving account se zyada ho sakta hai. Bank sirf ek fixed munafa deta hai jo bohot kam hota hai.

3. Hidden Charges Aur Fees

Bohot se banks transactions fees, ATM fees, aur monthly charges lagate hain jo kabhi kabhi account holders ko nahi pata hoti. Yeh chhoti chhoti fees mil kar ek acha khaasa amount ban sakti hain.

4. Har Waqt Access Nahi

Agar aap kisi aise area mein hain jahan bank branches ya ATMs nahi hain, ya agar banking system temporarily band ho jaye, to aapko paisa nikalne mein mushkil ho sakti hai. Yeh khas tor par un logon ke liye masla ban sakta hai jo jaldi paisa chahte hain.

Behtareen Hal Kya Hai? | Investment Ya Saving?

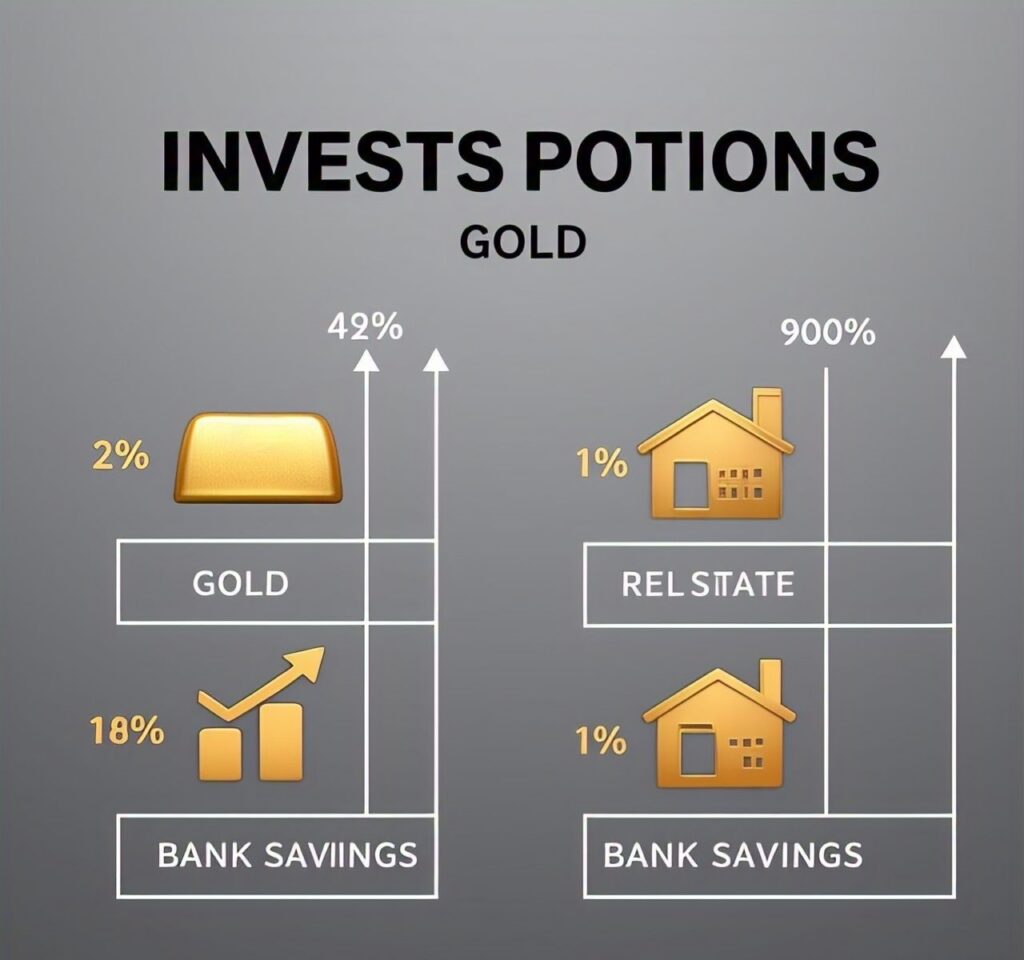

Agar aap chahte hain ke aapka paisa mehfooz bhi rahe aur barhta bhi rahe, to sirf bank account par bharosa karna behtareen option nahi hai. Aapko apni financial planning is tarah karni chahiye ke kuch paisa bank mein mehfooz rakhein, lekin kuch paisa investment options mein lagayein jese ke:

- Gold Investment: Gold aik aisi asset hai jo waqt ke saath apni value barhata hai. Agar aap savings ka kuch hissa gold mein invest karein, to long-term faida ho sakta hai.

- Real Estate: Property ya zameen mein invest karna aik acha option ho sakta hai agar aap ke paas zyada paisa hai aur aap long-term growth chahte hain.

- Stock Market: Agar aapko stock market ka knowledge hai to yeh ek behtareen investment ho sakti hai jo bank ke fixed munafe se bohot zyada return de sakti hai.

FAQs | Aam Sawalat Aur Un Ke Jawabat

1. Kya bank mein paisa rakhna safe hai?

Haan, bank mein paisa rakhna safe hota hai, lekin sirf saving karna behtareen option nahi hai. Aapko kuch paisa invest bhi karna chahiye.

2. Bank saving account par kitna munafa milta hai?

Har bank ka munafa rate mukhtalif hota hai, magar yeh aksar 4% se 8% tak hota hai jo inflation ko cover nahi karta.

3. Kya gold investment bank saving se behtar hai?

Gold ki value time ke saath barhti hai, isliye long-term gold investment bank saving se behtar ho sakti hai.

4. Kya mujhe apna sara paisa bank mein rakhna chahiye?

Nahi, aapko financial planning ke saath kuch paisa bank mein rakhna chahiye aur kuch invest karna chahiye taake inflation ka asar na ho.

5. Bank ki hidden fees se kaise bacha ja sakta hai?

Bank account open karne se pehle terms aur conditions achi tarah parhain aur aise bank ka intekhab karein jo low charges leta ho.

Conclusion | Akhri Soch

Bank mein paisa rakhna mehfooz option hai, lekin sirf saving karna aapke paisay ki value ko kam kar sakta hai. Behtar yeh hai ke aap apni financial strategy banayein, kuch paisa bank mein rakhein aur kuch gold, real estate ya stocks mein invest karein. Yeh approach aapko financial stability bhi degi aur inflation ka asar bhi kam karegi. Achi financial planning hi behtareen faisla hai!