Table of Contents

Lack of Financial Education | Maali Taleem Ki Kami

Aksar log paisa kama lete hain lekin usay samajhne aur barhane ka tareeqa nahi jante. Financial education ka matlab hai paisay ko sahi tareeke se invest karna, save karna aur manage karna. Iski kami ki wajah se log apni life mein kabhi financial stability achieve nahi kar pate.

Example:

Ali ek achha karobar chalata hai lekin har mahine sari kamai kharch kar deta hai. Usay ye nahi pata ke agar wo apni income ka kuch hissa invest kare to wo waqt ke saath ameer ban sakta hai. Financial education ki kami usko aage barhne se rokti hai.

Fear of Taking Risks | Risk Na Lena

Logon ki aksariyat naya karobar ya investment karne se ghabrati hai. Wo sirf safe tareeqay dhundtay hain jo unko ameer nahi banata balki aik limited life tak restricted rakhta hai. Risk lena zaroori hai lekin calculated risk lena aur sahi planning karna aur bhi zaroori hai.

Example:

Ahmed ke paas ek acha business idea tha lekin usne risk lene se dar ke wajah se kabhi start hi nahi kiya. 5 saal baad usne dekha ke usi idea se kisi aur ne acha paisa bana lia hai. Agar Ahmed ne thoda research aur planning ke saath risk liya hota to shayad aaj wo bhi successful hota.

Spending More Than They Earn | Kamai Se Zyada Kharch Karna

Bohat se log jitna kamaate hain usse zyada kharch kar dete hain, is wajah se wo kabhi bhi financially stable nahi ho paate. Wealth build karne ka basic principle hai ke jitna kamao uska ek hissa save karo aur invest karo taake wo barh sake.

Example:

Zeeshan ek achi job karta hai lekin har mahine ki salary luxury cheezon par kharch kar deta hai. Is wajah se wo kabhi apni financial position mazboot nahi kar sakta. Agar wo apni income ka 20-30% save ya invest kare to future mein financial freedom hasil kar sakta hai.

Not Investing in Assets | Assets Mein Invest Na Karna

Ameer banne ka aik sabse bara tareeqa assets mein invest karna hai. Assets wo cheez hoti hain jo aapko passive income deti hain jaise ke real estate, stocks ya phir gold. Passive income ke bina financial independence mushkil hoti hai.

Example:

Hassan aur Bilal dono ki salary barabar thi. Hassan ne apni income ka 20% gold aur real estate mein invest karna shuru kiya jabke Bilal sirf enjoy karta raha. 10 saal baad Hassan financially stable ho gaya lekin Bilal wahi ka wahi tha. Yeh sab assets mein invest karne ka farq hai.

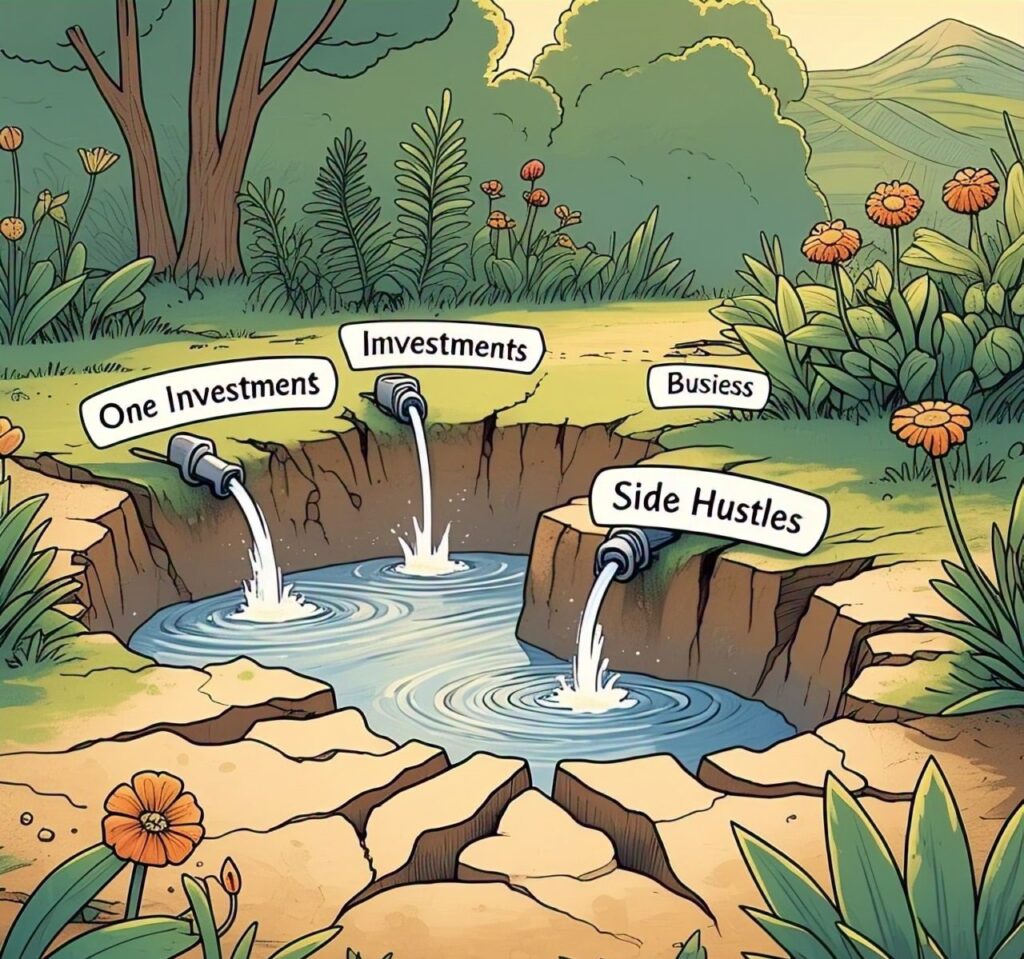

No Multiple Income Streams | Sirf Aik Income Source Par Bharosa

Sirf aik jagah se paisa kamane wale log kabhi bhi ameer nahi ho sakte. Ameer log hamesha multiple income streams par kaam karte hain. Jab ek income stream band ho jaye to doosri unka sahara ban sakti hai.

Example:

Sara aik private job karti thi lekin usne side hustle shuru ki aur aik YouTube channel banaya. Aaj uska passive income source bhi hai aur wo financially independent ho chuki hai. Isi tarah, gold trading ya freelancing bhi additional income sources ban sakti hain.

Not Adapting to Change | Naye Tareeqon Se Bachna

Duniya bohat tez change ho rahi hai. Agar aap naye trends aur technology ko nahi seekh rahe to aap peechay reh jaenge. Financial success ke liye zaroori hai ke naye tareeqon ko apnaya jaye aur market ki trends ko samjha jaye.

Example:

Farhan aik traditional business chalata tha lekin usne online marketing nahi seekhi. Jab uske competitors online aaye to uska karobar dheere dheere band ho gaya. Agar usne naye tareeqe seekhne par focus kiya hota to wo aaj bhi competitive hota.

Common FAQs | Aam Sawalat Aur Unke Jawabat

1. Ameer log paisa kaise banate hain?

Ameer log apni income ko sirf kharch nahi karte balki invest bhi karte hain. Wo multiple income streams create karte hain, assets mein invest karte hain aur financial education hasil karte hain.

2. Kya sirf salary se ameer bana ja sakta hai?

Sirf salary se ameer banna mushkil hai kyunki salary fixed hoti hai jabke ameer log passive income aur investments ka sahara lete hain. Side hustles aur smart investments zaroori hain.

3. Sabse acha investment kya hai?

Sabse acha investment wo hai jo long-term growth de sake. Jaise ke real estate, gold, stocks ya koi profitable business. Har insan ke financial goals alag hote hain, is wajah se investment ka tareeqa bhi alag ho sakta hai.

4. Gold investment kaisi hoti hai?

Gold ek safe investment hai jo waqt ke saath apni value barhata hai. Aksar log gold is wajah se invest karte hain kyunki ye inflation se bachata hai. Gold ki liquidity bhi achi hoti hai yani zaroorat par ise asani se becha ja sakta hai.

5. Kya sirf risk lene se ameer bana ja sakta hai?

Nahi, risk lena zaroori hai lekin sahi tareeqa aur planning bhi utni hi ahmiyat rakhti hai. Smart decisions lena bhi zaroori hai. Agar bina sochay samjhay sirf risk liya jaye to nuksan bhi ho sakta hai.

Agar aap in sab batoon ko apni zindagi mein apply karen, financial education hasil karein aur smart investment karein to aap bhi financial freedom hasil kar sakte hain!